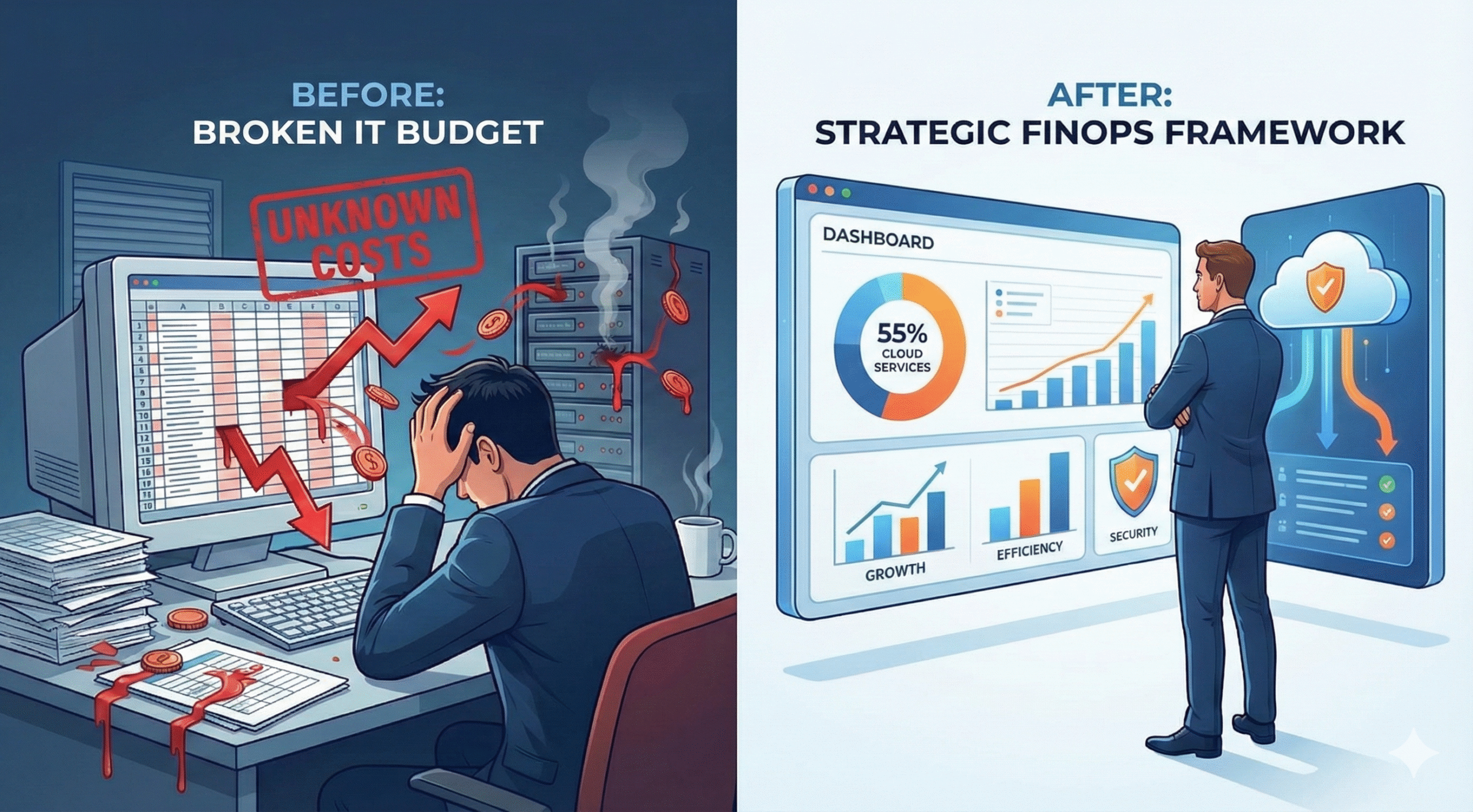

Your SMB IT Budget Is Bleeding Money. Here’s How to Stop It.

You know that feeling. It’s the end of the quarter, and you’re looking at an invoice from your cloud provider that makes absolutely no sense. It’s 30% higher than last month, and you have no idea why. Now you have to walk into your CEO’s office and try to justify a cost that feels more like a random number than a strategic investment.

Or maybe it’s the annual budgeting marathon. You take last year’s spreadsheet, add 5% for inflation, and call it a day, crossing your fingers that a server doesn’t die or a critical piece of software doesn’t suddenly triple its licensing fees.

Look, the old way of IT budgeting is broken. It treats technology as a cost center—a necessary evil to be minimized. But in 2026 and beyond, your IT spend isn’t just an expense line. It’s the engine of your growth, the guardian of your data, and the key to your team’s productivity.

Here’s the hard truth other IT providers won’t tell you: most SMB budgeting advice is dangerously outdated. They’ll tell you to allocate 15-25% of your budget to cloud services. But our research, backed by leading market analysis from firms like CloudZero and McCary Group, shows a seismic shift. Today’s competitive SMBs are allocating 50-55% of their total IT budget directly to the cloud.

If your budget doesn’t reflect this reality, you’re not just planning with bad data—you’re planning to fail.

This guide is different. We’re not going to give you a generic checklist. We’re giving you a new operating system for financial planning: The Strategic FinOps IT Budgeting Framework for SMBs. It’s a methodology designed to stop the financial leaks, justify every dollar spent, and transform your IT budget from a source of anxiety into your company’s most powerful strategic weapon.

Table of Contents

- Phase 1: Start with Strategy, Not Spreadsheets

- Phase 2: Choose Your Weapon—The Right Budgeting Model for Your Business

- A Deep Dive: How to Actually Run a Zero-Based IT Budget

- Phase 3: Allocate Like a Modern Business (The 55% Cloud Rule)

- Phase 4: Implement FinOps—Your Secret Weapon for Cost Control

- Stop Guessing, Start Planning: Your Next Steps

- Frequently Asked Questions About IT Budgeting

Phase 1: Start with Strategy, Not Spreadsheets

Before you open a single Excel file, you have to answer one question: What is the business trying to achieve this year?

Not what software you need to buy. Not which laptops need refreshing. What are the top 3-5 strategic goals for the entire company?

- Increase customer retention by 10%?

- Reduce sales cycle time by 5 days?

- Enter a new geographic market?

- Improve operational efficiency by 15%?

Every line item in your IT budget must be a direct answer to one of these goals. This is how you shift the conversation from “How much does it cost?” to “What is the return?”

Think of it in terms of three strategic pillars:

Growth: Technology that helps you acquire more customers and generate more revenue. (e.g., a new CRM, marketing automation software, e-commerce platform upgrades).

Efficiency: Technology that helps your team do more with less, reducing manual work and streamlining processes. (e.g., Microsoft 365 collaboration tools, project management software, internal automation scripts).

Security & Resilience: Technology that protects your assets, ensures you meet compliance requirements, and keeps the lights on. (e.g., advanced endpoint protection, data backup and disaster recovery solutions, employee security training).

Here’s what that looks like in practice. Instead of a budget line that says:

“New CRM Subscription: $15,000”

Your new strategic line item says:

“Growth Pillar: Reduce Sales Cycle Time by 5 Days. Investment: New CRM at $15,000 to automate follow-ups and improve lead tracking.”

See the difference? The first is an expense. The second is an investment with a clear, measurable business outcome. This is the first step in justifying your budget to leadership and getting the resources you actually need. Your entire managed IT services strategy should be built on this foundation.

Phase 2: Choose Your Weapon—The Right Budgeting Model for Your Business

Once you know your “why,” you can decide on the “how.” Most businesses default to an incremental budget (last year + X%), but this is lazy and often wasteful. For a modern SMB, there are two far more powerful options.

| Budgeting Model | How It Works | Best For… | Biggest Downside |

|---|---|---|---|

| Incremental (Traditional) | Take last year’s budget and add or subtract a percentage. Simple and fast. | Stable businesses with highly predictable costs and minimal change. (Honestly, very few modern businesses). | Encourages waste, doesn’t question existing spend, and is slow to adapt to new business needs. |

| Zero-Based Budgeting (ZBB) | Start from zero. Every single expense, old and new, must be justified based on its strategic value for the upcoming period. | Businesses seeking deep cost control, wanting to eliminate legacy waste, and needing to align every dollar to a specific goal. | Can be time-consuming for the first cycle and requires detailed justification for every line item. |

| Rolling Forecast | Maintain a continuous 12- or 18-month budget that is updated monthly or quarterly. Focuses on agility. | High-growth businesses, especially those with variable, consumption-based costs (like cloud/SaaS) where annual plans are obsolete in months. | Requires constant monitoring and a culture that is comfortable with frequent adjustments. |

For most SMBs looking to gain control and align spending with goals, a modified Zero-Based Budgeting approach is the gold standard. It forces the strategic conversations you need to have. For those heavily invested in the cloud, layering a Rolling Forecast on top of your ZBB plan gives you the agility to manage variable costs.

A Deep Dive: How to Actually Run a Zero-Based IT Budget

Competitors mention ZBB, but they don’t show you how to do it. It sounds intimidating, but it’s not. Here’s a simplified, four-step process:

Inventory Everything: Create a comprehensive list of every single IT-related expense. Every SaaS license, every hardware lease, every support contract, every cloud service. Don’t judge yet, just list.

Justify Its Existence: Go line by line. For each item, ask:

- Which strategic pillar (Growth, Efficiency, Security) does this support?

- What business outcome does it enable?

- Is it essential? Is there a better, more cost-effective alternative?

- What would happen if we cut it?

Prioritize and Package: Group your justified expenses into “decision packages.” For example, a package could be “Improve Sales Team Efficiency,” containing the CRM, a sales dialer tool, and data enrichment software. Rank these packages based on their impact on the company’s strategic goals.

Fund and Execute: Leadership now has a clear, prioritized list of investments, not just costs. They can choose to fund the top 10 packages, the top 15—whatever fits the overall financial picture. You’re no longer arguing about a single line item; you’re discussing strategic trade-offs.

Phase 3: Allocate Like a Modern Business (The 55% Cloud Rule)

This is where the rubber meets the road. Once you have your framework, you need to know where the money is actually going. Forget the outdated benchmarks. A 2026-ready IT budget for a competitive SMB looks something like this:

The Modern SMB IT Spend Breakdown:

Cloud Services (SaaS, IaaS, PaaS): 50-55%

This is your new reality. It includes everything from Microsoft 365 and Salesforce to your AWS/Azure hosting and specialized industry software. The massive jump here is driven by the shift from owning hardware (CapEx) to renting services (OpEx).

IT Labor (Internal & Managed Services): 20-25%

This covers salaries for your internal IT staff or the cost of your managed services provider. For many SMBs, outsourcing to a provider like DART Tech provides access to a full team of experts for less than the cost of one senior-level hire.

Cybersecurity: 10-15%

This is non-negotiable and growing. According to IDC, security is a top priority. This includes endpoint detection, firewalls, email filtering, security awareness training, and compliance management. Don’t skimp here; the cost of a breach is catastrophic.

Hardware (Lifecycle & Refresh): 5-10%

While cloud is dominant, you still have laptops, servers, and network gear. This allocation is for planned hardware refreshes (typically on a 3-5 year cycle) and moves from a large capital expense to a predictable operating expense.

Software (On-Premise & Licensing): <5%

This category is shrinking rapidly but may still include legacy accounting software or other on-premise applications.

Contingency & Innovation: ~5%

This is your fund for the unexpected and the new. A server fails. A new, game-changing AI tool emerges that you need to pilot. This buffer prevents you from having to rob other critical budget lines when opportunities or emergencies arise.

If your current budget breakdown looks radically different, it’s a massive red flag that you’re either underinvesting in critical growth areas (cloud, security) or overspending on legacy systems that are holding you back.

Phase 4: Implement FinOps—Your Secret Weapon for Cost Control

So, 55% of your budget is going to the cloud. The problem? Cloud costs are variable, complex, and can spiral out of control with a single misconfigured setting. This is why FinOps is no longer just an enterprise buzzword; it’s an essential survival skill for SMBs.

FinOps isn’t a tool you buy. It’s a cultural practice that creates collaboration between your technology, finance, and business teams to get the most value out of every dollar spent in the cloud. It’s how you tame that 55%.

Here’s a simple FinOps starter kit for any SMB:

Visibility through Tagging: The first rule is you can’t control what you can’t see. Implement a strict “tagging” policy for all your cloud resources. Tag everything by department (Marketing, Sales), project, or client. This way, when you get that massive AWS bill, you know exactly who spent what and why.

Accountability with Budgets & Alerts: Set budgets for each department or project within your cloud provider’s console. More importantly, set up automated alerts that notify you when spending hits 50%, 75%, and 90% of the budget. This turns reactive panic into proactive management.

Optimization through Rightsizing: Most companies over-provision their cloud servers, paying for capacity they never use. Regularly analyze your usage data (a good MSP can do this for you) and “rightsize” your instances to match their actual workload. This simple step can often cut cloud bills by 20-40% without impacting performance.

Forecast for the Future: As you gather more data on your cloud usage, you can start making more accurate forecasts. This is critical for budgeting for emerging technologies like AI. According to IDC, over half of SMBs are adjusting budgets for AI spending. You can’t do that with a static, annual plan. You need real-time data to model the cost and potential ROI of these new tools.

Implementing a FinOps culture is the final piece of the puzzle. It connects your strategic plan (Phase 1) and your budget model (Phase 2) with the day-to-day reality of your spending (Phase 3), creating a virtuous cycle of planning, monitoring, and optimizing. This is the core of a robust cybersecurity and compliance posture—knowing where your money and your data are at all times.

Stop Guessing, Start Planning: Your Next Steps

Building a strategic IT budget is not a once-a-year administrative task. It’s an ongoing business process that, when done right, fuels growth, manages risk, and provides a predictable financial path forward.

By abandoning the outdated “add 5%” model and embracing the Strategic FinOps IT Budgeting Framework, you can:

- Stop defending costs and start demonstrating value.

- Eliminate wasted spend on legacy tech and underutilized licenses.

- Gain control and predictability over your largest and most volatile expense category: the cloud.

- Make confident, data-driven decisions that align your technology investments directly with your most important business goals.

This framework isn’t just theory. It’s the exact process we use to help our clients in Tampa and the surrounding areas transform their IT from a liability into their greatest competitive advantage.

If you’re tired of the budget guesswork and ready to build a technology plan that actually drives your business forward, let’s talk. Schedule a no-obligation discovery call with one of our IT strategists today. We’ll help you assess your current spend, identify opportunities for optimization, and build a budget that makes sense for 2026 and beyond.

Frequently Asked Questions About IT Budgeting

What percentage of revenue should an SMB spend on IT?

This is the most common question, but it’s often the wrong one. The old benchmark was 4-6%, but this is increasingly irrelevant. A tech-forward company in a high-growth phase might spend 10-15%, while a stable manufacturing firm might spend 3%. Instead of focusing on revenue percentage, focus on business outcomes. What investment is required to hit your strategic goals? The Strategic FinOps Framework helps you build a budget from the bottom up based on value, not a generic top-down percentage.

Isn’t Zero-Based Budgeting (ZBB) too much work for a small team?

The first cycle of ZBB requires more effort, that’s true. But the clarity and cost savings are immense. Think of it as a deep clean for your finances. After the first year, the process becomes much faster because you have a clean baseline. For an SMB, you can simplify the process by focusing on the top 80% of your spend and doing a full ZBB cycle every two years, with a lighter review in the off-year.

My cloud costs are too unpredictable. How can I possibly budget for them?

This is precisely the problem FinOps solves. You can’t budget for chaos, but you can manage variability. By implementing tagging, setting alerts, and conducting regular rightsizing reviews (Phase 4), you introduce predictability into the system. You move from being a victim of your bill to being the architect of your spend. A rolling forecast, updated quarterly, is the perfect tool for managing this.

Should I budget for IT as a Capital Expense (CapEx) or Operating Expense (OpEx)?

The trend is overwhelmingly towards OpEx. The 55% allocation to cloud services is a perfect example of this. Instead of buying a $20,000 server (CapEx) that you have to depreciate over five years, you pay a monthly fee for cloud hosting (OpEx). This model provides greater flexibility, scalability, and predictability. While some CapEx for hardware remains, a modern IT budget is primarily OpEx-driven. This often makes it easier to get approval for new projects, as they don’t require a large upfront capital outlay.