You’ve found the perfect technology solution. You see how it will streamline everything, eliminate those soul-crushing manual tasks, and maybe, just maybe, let your team leave the office on time for once. You’ve built the proposal, polished the deck, and you’re ready to present it.

Then comes the question from the CFO, the CEO, or the board: “What’s the ROI?”

And suddenly, the conversation shifts from possibility to pure numbers. You can talk about efficiency gains and better morale, but they want to see a percentage. They want a payback period. And if you can’t provide a rock-solid, defensible business case, that game-changing investment gets stuck in “budgetary review” forever.

Look, justifying technology spending is tough. It’s not just about the upfront cost versus the direct savings. The true value is often hidden in things that are notoriously hard to measure—like happier customers, less stressed employees, and the disaster that didn’t happen because your security was finally up to snuff.

This isn’t just another article with a basic ROI formula. This is a complete framework for building a business case that even the most skeptical CFO will have to respect. We’re going to move beyond simple math and show you how to calculate the total cost of ownership (TCO), quantify the “unquantifiable” benefits, and put it all together in a strategic scorecard that proves the true value of your investment.

Table of Contents

- The Foundation: TCO vs. ROI, Demystified

- The Standard Calculation: Your Step-by-Step Guide

- Step 1: Uncover Every Cost with Total Cost of Ownership (TCO)

- Step 2: Identify Your Tangible Returns (The Easy Part)

- Step 3: Running the Numbers (ROI, Payback, NPV)

- The Real Game-Changer: How to Quantify Intangible Benefits

- Method 1: Valuing Productivity and Employee Experience

- Method 2: Valuing Customer Experience and Retention

- Method 3: Valuing Risk Reduction and Cybersecurity

- The Complete Framework: Your Technology Investment Scorecard

- A Reality Check: Data-Backed ROI Benchmarks

- Key Takeaways for Your Next Budget Meeting

- Frequently Asked Questions About Tech ROI

- From Calculation to Confidence

The Foundation: TCO vs. ROI, Demystified

Before we dive deep, let’s clear up the two most important acronyms in this conversation. People often use them interchangeably, but they tell two very different sides of the same story.

Total Cost of Ownership (TCO) is about the cost. It’s the full, unvarnished truth of what a piece of technology will cost you over its entire lifecycle, from the initial purchase to the day you pull the plug. It’s the sticker price plus all the hidden fees.

Return on Investment (ROI) is about the value. It measures the financial gain (or loss) from an investment relative to its cost. It answers the question, “For every dollar we put in, how many dollars do we get back?”

Think about it this way:

| Metric | What It Asks | Focus | Use Case |

|---|---|---|---|

| TCO | “What will this really cost us over three years?” | Expense & Planning | Comparing the true cost of two competing software solutions. |

| ROI | “Was this investment worth it?” | Profitability & Justification | Proving that a new CRM generated more revenue than it cost. |

You can’t calculate a meaningful ROI without first understanding the TCO. TCO is the “I” (Investment) in the ROI equation. Getting it wrong is the number one reason technology business cases fall apart under scrutiny.

The Standard Calculation: Your Step-by-Step Guide

Let’s start with the basics. This is the “table stakes” calculation you absolutely must have.

Step 1: Uncover Every Cost with Total Cost of Ownership (TCO)

The initial quote is just the beginning. A true TCO analysis digs into every potential cost, direct and indirect. Forgetting these is like buying a “cheap” car and then realizing it needs premium fuel and has astronomical insurance rates.

Here’s a checklist to get you started:

Acquisition Costs (The Obvious Stuff):

- Software licensing or subscription fees

- Hardware purchase price

- Initial consulting or setup fees

Implementation & Integration Costs (The “Getting Started” Stuff):

- Data migration from old systems

- Integration with existing software (your ERP, CRM, etc.)

- Initial employee training and onboarding

- Project management overhead

Operational Costs (The “Keeping it Running” Stuff):

- Ongoing support and maintenance contracts

- Infrastructure costs (server space, cloud hosting)

- Upgrades and patching

- IT staff time dedicated to managing the new tech

Hidden & Long-Term Costs (The Stuff Everyone Forgets):

- Downtime during implementation or from system failures

- Ongoing training for new hires

- Security and compliance management

- Decommissioning costs for the old system you’re replacing

Add all this up over a specific period (usually 3-5 years) to get your true TCO. This number is your “Investment.”

Step 2: Identify Your Tangible Returns (The Easy Part)

These are the direct, easy-to-measure financial benefits. They typically fall into two buckets: cost savings and revenue generation.

Cost Savings:

- Reduced headcount or reallocated labor

- Lower maintenance costs from retiring old systems

- Decreased spending on materials or supplies

- Reduced infrastructure footprint (e.g., fewer servers)

Increased Revenue:

- Ability to process more orders or serve more clients

- Faster time-to-market for new products

- Upsell/cross-sell opportunities enabled by the new tech

Sum these up over the same period as your TCO. This is your “Gain.”

Step 3: Running the Numbers (ROI, Payback, NPV)

Now you have the two key ingredients. Here’s how to use them:

Basic ROI Formula:

(Net Gain from Investment – Cost of Investment) / Cost of Investment * 100

If your net gain over 3 years is $500,000 and your TCO was $200,000, your ROI is ($500,000 – $200,000) / $200,000 * 100 = 150%.

Payback Period:

Cost of Investment / Annual Net Gain

This tells you how long it takes to earn back your initial investment. Using the example above, if the annual net gain is $166,667 ($500k/3 years), the payback period is $200,000 / $166,667 = 1.2 years.

Net Present Value (NPV): This one is a bit more advanced, but it’s what your CFO really cares about. It accounts for the time value of money—the idea that a dollar today is worth more than a dollar tomorrow. A positive NPV means the investment is projected to be profitable.

If you stop here, you’re already ahead of most. But you’re still leaving the most powerful arguments on the table.

The Real Game-Changer: How to Quantify Intangible Benefits

This is where you go from building a good business case to an undeniable one. Intangible benefits—like improved morale, better security, and happier customers—feel “soft,” but they have very real, very hard financial consequences. The trick is learning how to assign a dollar value to them.

Here are three powerful methods to do just that.

Method 1: Valuing Productivity and Employee Experience

When a new tool saves everyone 15 minutes a day, what’s that actually worth?

- Calculate Time Saved: Survey your team. If a new project management tool saves 10 employees an average of 3 hours per week, that’s 30 hours saved per week.

- Determine the Fully-Loaded Employee Cost: This isn’t just salary. It’s salary plus benefits, taxes, and overhead. A good rule of thumb is 1.25 to 1.4 times their salary. Let’s say the average fully-loaded hourly rate for these employees is $50.

- Monetize the Time: 30 hours/week x 50 weeks/year x $50/hour = $75,000 per year.

That $75,000 is a hard number you can add to your “Gains.” You can use the same logic for reduced employee turnover. Calculate the cost to replace an employee (hiring, training, lost productivity), and if your new tech improves retention by even a small amount, the savings are significant.

Method 2: Valuing Customer Experience and Retention

Happy customers stay longer, spend more, and refer others. Unhappy customers churn. New technology, like a better CRM or a self-service portal, can directly impact this.

- Connect Tech to a CX Metric: Identify how the technology will improve a key metric like Net Promoter Score (NPS) or Customer Satisfaction (CSAT). For example, you might project that a new support ticketing system will improve your CSAT score by 10%.

- Link the Metric to Behavior: Look at your historical data. What’s the difference in the annual churn rate between customers with high CSAT scores and those with low scores? Let’s say a 10% CSAT improvement correlates with a 2% reduction in churn.

- Calculate the Financial Impact: If you have a $5 million customer base and you reduce churn by 2%, that’s $5,000,000 * 2% = $100,000 in retained revenue per year.

Suddenly, “improved customer satisfaction” isn’t a fluffy benefit; it’s a six-figure line item in your ROI calculation.

Method 3: Valuing Risk Reduction and Cybersecurity

This is absolutely critical but often overlooked. What is the value of a data breach that doesn’t happen? For this, we can borrow a concept from the insurance and risk management world: Annual Loss Expectancy (ALE).

ALE = Single Loss Expectancy (SLE) x Annual Rate of Occurrence (ARO)

- SLE: The total cost of a single incident. For a data breach, this includes fines, remediation costs, lost business, and reputational damage.

- ARO: How likely the incident is to happen in a given year.

Let’s say the potential cost (SLE) of a ransomware attack on your business is $1 million. Based on industry data and your current vulnerabilities, you estimate the likelihood (ARO) of this happening is 10% this year.

Your current ALE: $1,000,000 x 0.10 = $100,000

Now, you invest in new, advanced cybersecurity solutions that reduce that likelihood to just 1%.

Your new ALE: $1,000,000 x 0.01 = $10,000

The difference—$90,000 per year—is the monetized value of your risk reduction. That’s a powerful, tangible return you can add to your business case, demonstrating how proactive managed IT services aren’t just a cost center but a value driver.

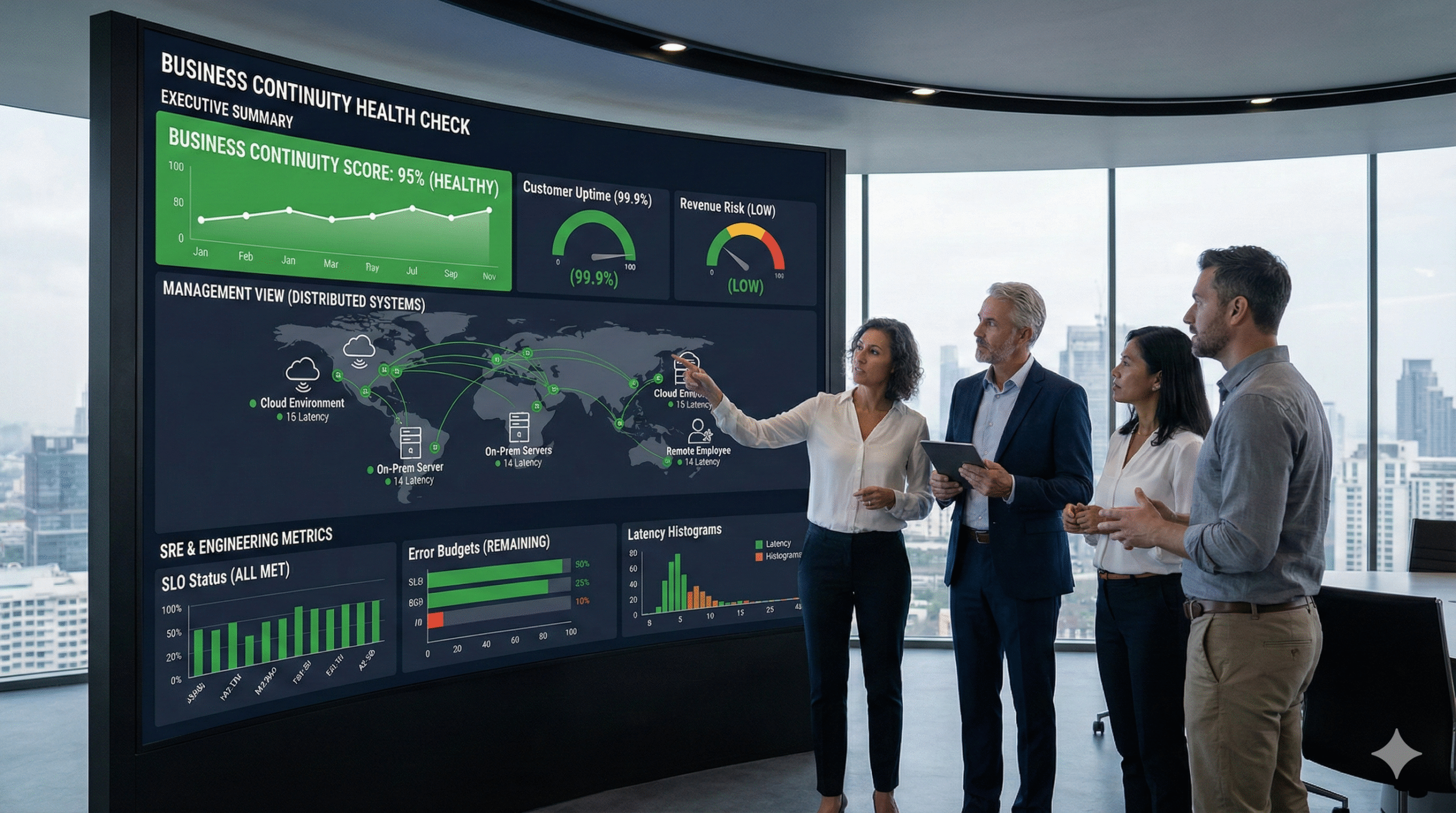

The Complete Framework: Your Technology Investment Scorecard

Okay, we have financial metrics (ROI, NPV) and we’ve quantified our intangible benefits. Now, how do we put it all together to make a final decision, especially when comparing multiple options?

The answer is a blended scoring model. This moves beyond a purely financial view and forces you to evaluate the investment against your core business strategy. Instead of asking “Which has the best ROI?”, you ask “Which best moves our business forward?”

Here’s a sample Technology Investment Scorecard. You can weight the categories based on your company’s priorities for the year.

| Category (Weight) | Criteria | Project A Score (1-5) | Project B Score (1-5) |

|---|---|---|---|

| Financial Value (30%) | Projected 3-Year ROI, Payback Period, NPV | 4 | 5 |

| Strategic Alignment (30%) | Supports key company goals (e.g., market expansion, customer retention) | 5 | 3 |

| Risk Reduction (20%) | Improves security, ensures compliance, enhances data backup and recovery | 5 | 2 |

| Implementation Viability (20%) | Technical feasibility, cultural fit, resource availability | 3 | 5 |

| Weighted Total Score | 4.3 | 3.8 |

In this scenario, Project B has a slightly better financial return on paper. But when you look at the whole picture, Project A is the clear strategic winner because it aligns better with company goals and drastically reduces risk. This is the kind of analysis that demonstrates true strategic thinking.

A Reality Check: Data-Backed ROI Benchmarks

How do your projections stack up against reality? Grounding your business case in external data adds a powerful layer of credibility.

- Spending is Significant: Businesses now spend, on average, 7.5% of their total revenue on technology. This isn’t a minor line item; it’s a core operational investment.

- Integration is Everything: Here’s a staggering statistic from Integrate.io: Organizations with well-integrated tech stacks achieve an average of 10.3x returns on their investment. Those with poorly integrated, siloed systems? Just 3.7x. This highlights the value of a holistic strategy, not just point solutions.

- Change Management is a Multiplier: It’s not just about the tech; it’s about the people using it. According to McKinsey, organizations with effective change management programs see 143% of their expected ROI. Those without it limp along at a mere 35%. Factoring in training and adoption support isn’t an expense; it’s insurance on your return.

- AI ROI is Complicated: Deloitte reports that while 84% of leaders believe AI is critical to their success, MIT research shows that almost half of AI models never even make it into production. The promise is huge, but the path to value is narrow. True ROI requires deep expertise in deployment and integration.

These stats prove a crucial point: the return isn’t in the technology itself, but in how it’s implemented, integrated, and adopted. Partnering with experts who manage the entire lifecycle—from planning and cloud solutions deployment to ongoing support—is what separates a 3x return from a 10x return.

Key Takeaways for Your Next Budget Meeting

If you only remember a few things, make them these:

- What is the true cost of technology? The true cost is the Total Cost of Ownership (TCO), which includes not just the purchase price but also implementation, training, support, and hidden operational costs over 3-5 years.

- How do you calculate technology ROI? The basic formula is (Net Gain – TCO) / TCO x 100. But a truly defensible ROI must also quantify intangible benefits like productivity gains, improved customer retention, and reduced cybersecurity risk.

- Why is TCO important for ROI? TCO provides the accurate “Investment” figure for your ROI calculation. Underestimating the TCO will artificially inflate your projected ROI, leading to a business case that falls apart under scrutiny.

- What’s a better approach than ROI alone? Use a blended Technology Investment Scorecard. This framework evaluates projects not just on financial returns but also on strategic alignment, risk reduction, and implementation viability, providing a more holistic and defensible basis for decision-making.

Frequently Asked Questions About Tech ROI

Q: Our main goal is improving employee morale with new tools. How can I possibly sell that to our CFO?

A: Don’t sell “morale,” sell the financial outcome of good morale. Use the productivity formula (Time Saved x Fully-Loaded Salary) to calculate efficiency gains. Then, find your company’s employee turnover rate and the average cost to replace an employee. Even a small, projected decrease in turnover due to better tools can translate into tens or hundreds of thousands of dollars in savings.

Q: This seems like a lot of work. Can’t I just use the vendor’s ROI calculator?

A: A vendor’s calculator is a starting point, but it’s a sales tool. It’s designed to show their product in the best possible light. It will likely underestimate the TCO (by omitting costs like internal project management or complex integration) and overestimate the gains. You must do your own, unbiased analysis to build a credible internal case.

Q: What’s a “good” ROI for a technology project?

A: There’s no single magic number. It depends entirely on your industry, the risk of the project, and your company’s own internal investment hurdles. A safe, incremental upgrade might be approved with a 50% ROI, while a riskier, more transformative project might need to show a projected ROI of 200% or more to get the green light. The key is to be more compelling and strategically aligned than the other projects competing for the same budget pool.

Q: We’re a small business. Isn’t this kind of detailed analysis overkill for us?

A: Absolutely not. In fact, it’s arguably more important for a small business where every dollar counts and a bad investment can have a much bigger impact. Scaling down the process doesn’t mean skipping it. Even a back-of-the-envelope TCO and a clear-eyed look at how a new tool like Microsoft 365 will directly save time or enable more sales is crucial for making smart decisions with limited capital.

From Calculation to Confidence

Building a defensible business case for technology is less about complex spreadsheets and more about telling a compelling, data-backed story. It’s about connecting your proposed investment to the things your leadership truly cares about: profitability, strategic growth, and risk mitigation.

By moving beyond the sticker price to a full TCO, quantifying the powerful intangible benefits, and evaluating options through a strategic lens, you transform your request from a “cost” into a well-researched, undeniable “investment.”

But you don’t have to do it alone. The difference between a 3x and a 10x return often comes down to the strategic expertise of the partner you choose for implementation and management. If you’re ready to build a technology strategy that delivers measurable, predictable returns, let’s talk.

Schedule a consultation with a DART Tech strategist today and let’s build your business case together.